But, after this period, the interest rate may adjust annually or at predetermined intervals, based on a specific index and margin.Īs the interest rate adjusts, the monthly mortgage amortization payment can change. The loan amortizes just like a fixed-rate mortgage. This leads to changes in the monthly mortgage payment over time.ĭuring the initial fixed-rate period typically 5 to 10 years, the interest rate remains the same. With an ARM, lenders periodically adjust the interest rate based on market conditions. Although, the amount applied to the principal and interest will change monthly.įixed-rate mortgages are ‘fully amortizing’ meaning your loan is closed once you make all payments.įixed-Rate Mortgage : Learn what a fixed-rate mortgage is, how it works, its pros and cons, and whether it’s for you! Amortization With Adjustable-Rate MortgagesĪmortization is a key aspect of adjustable-rate mortgages (ARMs). With a fixed-rate mortgage, the interest rate remains constant throughout the loan term. Regular payments reduce the loan balance and by the end of the amortization period, your loan is over. Mortgage amortization is when a borrower repays their loan gradually through regular monthly payments.Įach payment includes both principal (the borrowed amount) and interest (the borrowing cost), with the division changing over time.

Amortization excel free#

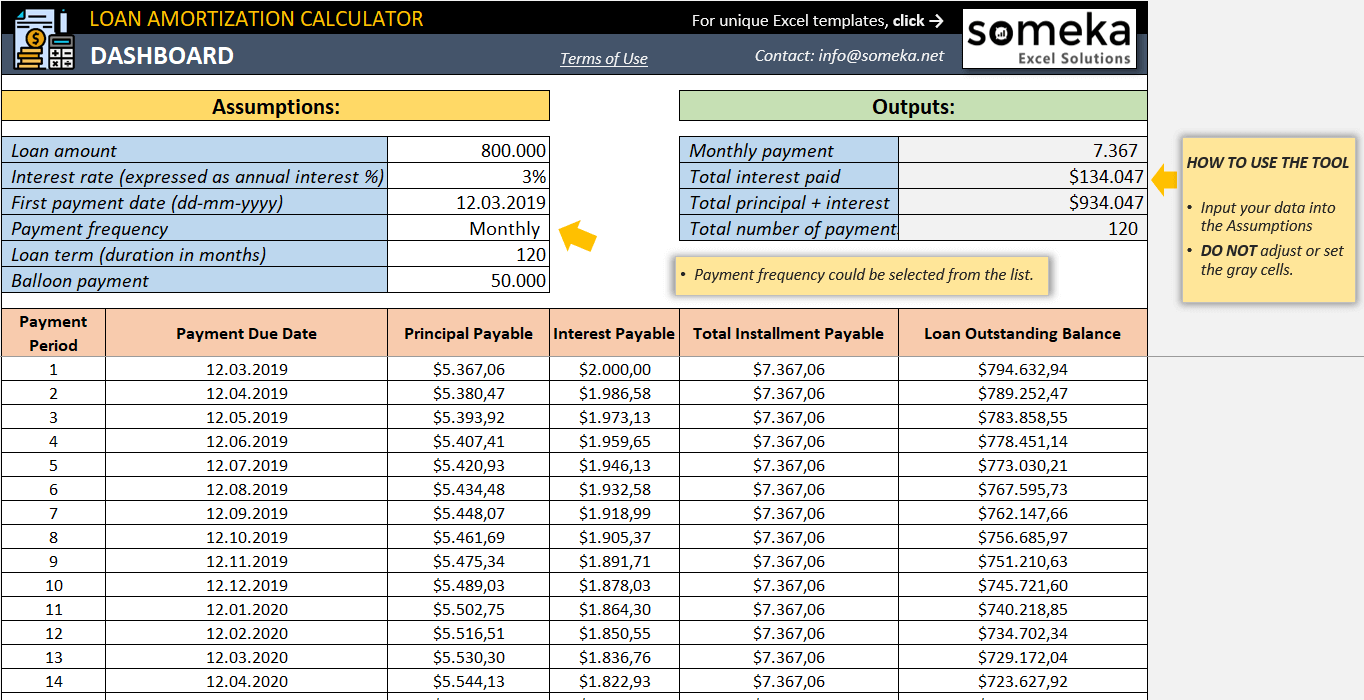

Amortization Schedule for Mortgage: Check out Houzeo’s free amortization excel template to create your own.

Over time, more of your payment goes towards reducing the principal and less towards interest.

Amortization excel how to#

0 kommentar(er)

0 kommentar(er)